Abuse of dominant position enforcement: go quick or go home

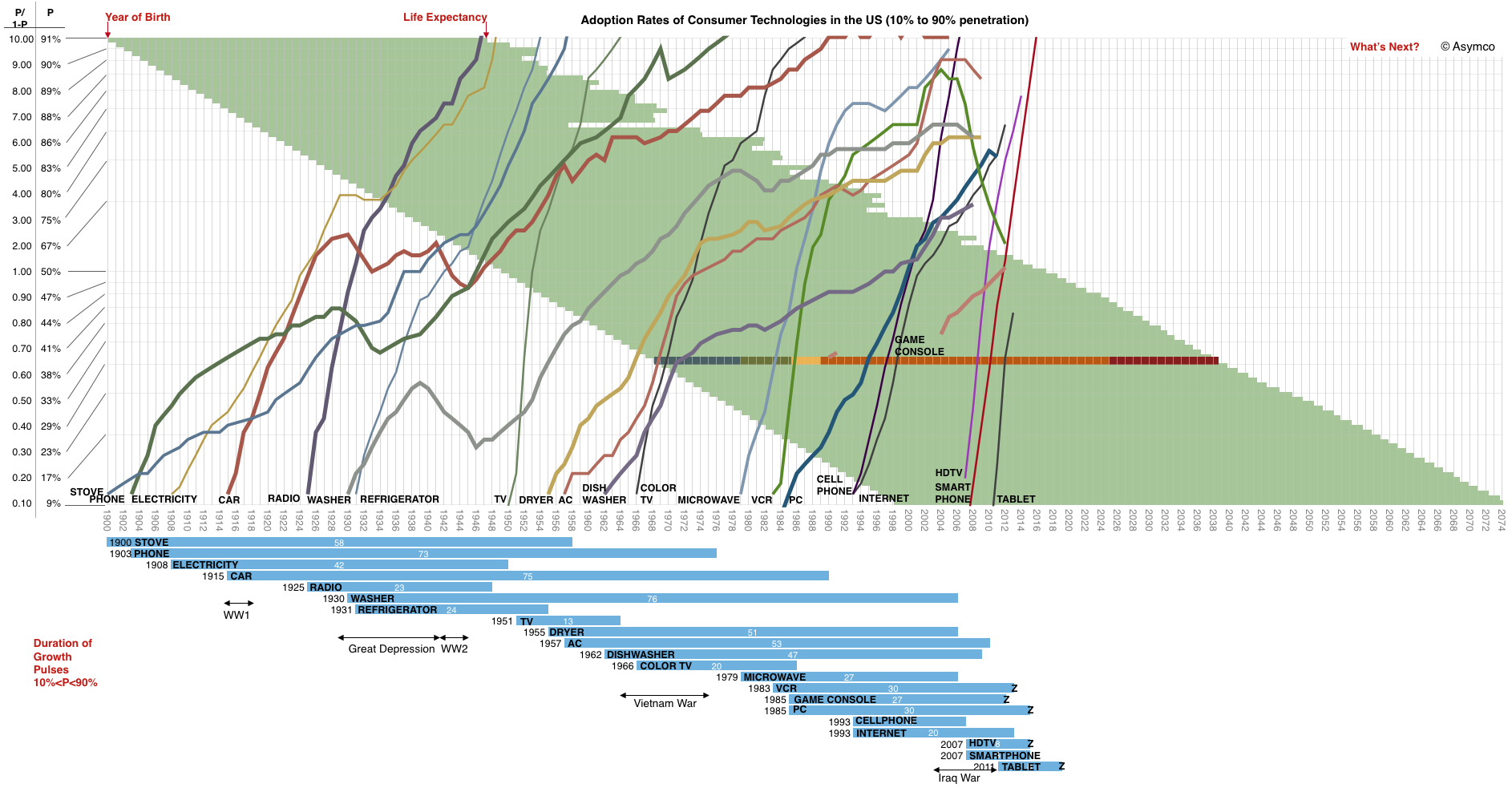

I have a soft spot for technology and related topics. Over the last couple of years, most of my attention has been on the increasing speed at which new technologies enter the market and go on to establish a dominant position. This is not my idea and people way smarter than me have harped about this for ages. Here's a good example by Horace Dediu from 2013:

The time lag between going from 10% of an addressable market to 90% is getting shorter as time goes on. In consequence, there is no surprise that in "technology enabled" (or sensitive) sectors, we end up with a dominant technology which often is controlled by a single provider. It is true also that the increase in market penetration speed leads to technologies being replaced sooner rather than later. This is particularly true of consumer technologies where platform and network effects are at play.

The current state of affairs has stark effects for competition law enforcement, particularly abuse of dominant position. If any given dominant position is getting shorter, how can we have final decisions with effective remedies in a time frame that makes a difference? The bulk of my argument is that EU competition law enforcement today is simply too slow for any (final) decision to have any meaningful impact in a market subject to quick technological changes. Allow me to provide some past examples, before getting to today and the future

Let's talk phones

Telephones are a great example. Landlines took 50 years to reach a 90% penetration rate in the USA (see image above). Feature phones only took 9 years to do so. However, both are on the wane. I do not have the data for landlines, but cell phones were down to 60% marketshare in 2011 and by 2013 they had been overtaken by the smartphone. By 2015 the smartphone reached 89% of the USA's population. If we take the iPhone launch in late 2007 as the watershed moment for smartphones, they reached the 90% threshold in only 7-8 years even though the average selling price for handsets today is higher than it was in the feature phone generation.

And who were the big players of the feature phone generation? Nokia, Motorola, Samsung, SonyEricsson (nee Ericsson), RIM, Siemens, Alcatel, etc. What do all these feature phone makers have in common? Virtually none is alive today with the exception of Samsung and Sony (Motorola was first acquired by Google and then Lenovo). They all missed the jump for the next big thing and became fringe players if anything.

If say Nokia abused a dominant position in its feature phone heyday, no amount of remedy would have changed the outcome. But I am not claiming Nokia abused its dominant position. Microsoft, however...

What about Microsoft?

Microsoft however, is a perennial candidate for abuse of dominant position accusations. It has gone through a few grillings (anyone remember Netscape?) and in the EU there is a particular case all competition law students are at least familiar with: Microsoft v Commission (Case T-201/04). The process leading to Microsoft v Commission started in 1998 with a complaint by Sun Microsystems (another casualty of creative destruction) which led to a preliminary decision by the Commission in 2003 and a final judgment by the Court of Justice in 2007. A cool 9 years from start to finish. Oh wait, Microsoft did not comply with the decision and was fined again in 2008 by the Commission, before an appeal to the Court of Justice which settled the issue in 2012. 14 years from start to finish then. Oh, and that is not even the "browser choice" case which was only concluded in 2013...

In the end, the remedies aiming to protect competition became redundant as technology moved on. Microsoft no longer has a dominant position on the server market and its relevance in personal computing is much reduced when tablets and/or smartphones are added to the mix in addition to laptops and desktops.

Again, change in the market was brought about not because of the competition law remedies (which were just upheld for the most part in 2012) but due to new technologies replacing Microsoft offerings, mostly smartphones and tablets. Microsoft botched the jump, that is all.

In a sense, 2004-2007 represents the high water mark for Microsoft's "market influence" and the coincidence of regulatory intervention right at the peak indicates a clear lag on its activity and the production of its effects. Again, I cannot claim this is my idea as the case was beautifully put by Ben Thompson and James Allworth on this Exponent podcast episode. Which brings me to the current occupier of the dominant position hot seat: Google.

Google who?

Google has been in subject to competition law investigations for abuse of dominant position(s) in the EU for some time. ArsTechnica has a great roundup of the company's run ins with EU competition law enforcement. In summary there are two main competition cases against Google at this moment in time. One, started in 2010 based on its comparison shopping practice of giving higher relevance to its own products and where the Commission only produced its preliminary findings in 2015. Then, earlier this year the investigation into Android.

In both situations we are years (nay a decade) away from a final decision. The Commission will come up with is proposed remedies and fines, things will go back and forth before reaching the Court of Justice where they will stay cooking in a very low heat for a few years. And then what? By the time we have a final decision, any remedies designed to protect competition in the affected markets will simply be out of date and pretty much irrelevant for the technological landscape. By the time the dust has settled, search will probably no longer be done on a browser (making the first case redundant) and Android will be a footnote in history, replaced by new platforms such as VR, Augmented Reality or the IoT (speculative, who knows?) Before we get there, however, we will probably stop at a small station called "messaging".

Whatsapp with you?

The next battleground for dominant positions is probably going to be mobile messaging. Mobile messaging has the characteristic of being composed by both networks and apps. Only the apps supported/authorised by the network can use it, thus putting a significant power in the hands of the network owner or operator.

Messaging apps fall prey to network effects: the usefulness/perceived value of a mobile messaging service goes up exponentially with an arithmetic increase of users. It is a good example of a "winner take all" market, or in other words, a market where there is a tendency for a natural monopoly to emerge.

We can slice and dice messaging apps in many different ways to define the market for purposes of determining the existence of a dominant position. A simple way to do it would be to separate one to one from group messaging networks. As far as European markets go, in the first we have the good old SMS or Apple's iMessage and in the second Google Hangouts (sorry, Allo?), Facebook Messenger, Whatsapp in addition to a string of smaller players. For the purposes of this blogpost, my interest is in the second category, where one should expect consolidation to occur in the next few years and a clear winner (or winners) to emerge sooner rather than later. In fact, in Europe the winner has already been found: Whatsapp.

Whatsapp is a particularly good example to look at in the context of abuse of dominant position enforcement in technology enabled sectors. The company was established in 2010 and acquired by Facebook in 2014.

As of 2014 Whatsapp was installed in more than 50% of all smartphones in Spain, Italy, Netherlands and Germany. In the UK and Ireland, the figure was 34%. Another stat puts the total installed user base in "Europe" at 33% in late 2015, not far from the 40% dominant position presumption threshold. Personally, I suspect current numbers are probably higher as the company claimed in February 2016 having a user base of 1 billion, doubling in just two years. I know that the share of installed user base as a percentage of the total number of smartphones used is only a proxy for actual use, but a decent one at that.

We can divide Whatsapp into two separate components: the Whatsapp network and the Whatsapp client. As of today, only the official Whatsapp client can connect to the network. But it was not always like that. Until early 2015, third party clients could connect to the Whatsapp network, providing users with alternatives to the official client. While there might have been some reasonable reasons for the ban (security and privacy concerns, lack of resources to manage/investigate all third party clients) the fact is Whatsapp banned all third party clients from its network even those which provided real added value over and above the official client. On a different network, many of features we now take for granted on Twitter were actually created by third party clients (mobile app, pull to refresh, url shortening, etc).

Going forward, Whatsapp banning third party clients also forecloses the possibility of new technical developments and products to be developed for the Whatsapp network by third party developers. For example, what if someone wanted to create a functionality which allowed users to send money to one another over the network (as WeChat allows since 2014)? Or a concert promoter to sell tickets via an integrated payment system like Paypal or Square? It is fair to say that by banning third party developers, Whatsapp may be foreclosing the possibility of new innovations with a real market from appearing.

And that brings us full circle to the Microsoft dominant position abuse case mentioned above. In that case, the General Court held that Microsoft had abused its dominant position by restricting technical development, a significant departure from previous cases where the potential for new products had been required. While I still think Whatsapp third party clients have the potential to unleash new products which is currently foreclosed, the company would be unable to meet the restriction of technical development set in Microsoft.

There is no indication Whatsapp is going to be investigated for abuse of dominant position. Even if it was, the full process from start of investigation to actual enforcement of remedies would surely take over a decade to run. In consequence, it is likely that the remedies would effectively be applied at a moment in time where Whatsapp no longer has a dominant position or even the remedies no longer have an actual useful effect due to technological advancements.

Conclusion

Of course that the points I am raising here are debatable - but that is also part of the problem. The debate (ie, investigation and enforcement of a final decision) on the dominant position should occur within a timeframe which allows for useful remedies to be implemented while they still make sense.

The current EU abuse of dominant position enforcement system is ill suited for technology enabled sectors in the 21st century and there are two ways of reforming it. One, would be to make all stages quicker (a lot quicker) so that remedies have a chance to work instead of being applied out of time. The second option would be to make do with enforcement at all since today's dominant positions are inherently unstable (a topic for another post) and as the speed of market penetration by new technologies accelerates, the period of dominance for any given company/technology becomes shorter and shorter thus muting the need for enforcement.

Abuse of dominant position enforcement, please go quick or go home.